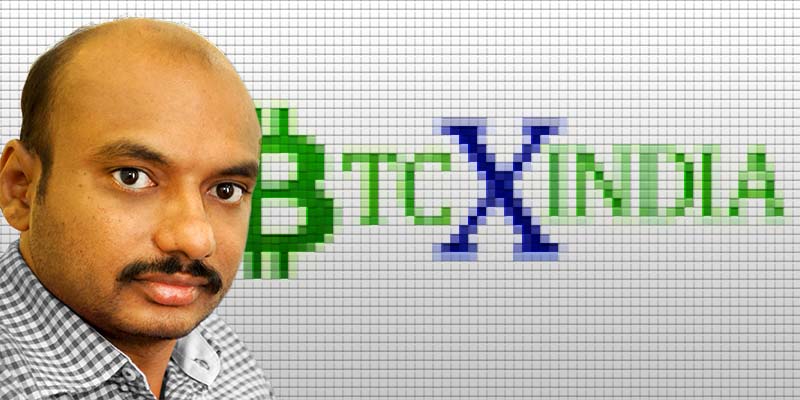

BestCoinExchange brings to you another exclusive interview with people behind crypto currency exchanges. This time we had a chance to sit down with Rao Mupparaju, Chief Executive Officer of BTCXIndia. He shared some insights about bitcoin and crypto currency exchange business, as well as the impact of virtual currencies to developing markets.

BestCoinExchange (BCE): First of all, why did you choose to come to crypto currency business? Was it related with your previous occupation? How did you come up with an idea to open a crypto currency exchange?

Rao Mupparaju (RM): I was living in Singapore and working as a trader in the FOREX markets when I was first introduced to Bitcoin, and I have worked with trading & analysis of financial markets for most of my career; currencies, equities as well as commodities. Bitcoin immediately caught my interest and I wanted to get involved in the industry, and as there weren’t really any reliable exchanges available for Indian customers I decided to move back to India and start one myself.

BCE: Can you introduce the exchange you represent? Are you backed by third party investors? How many employees do you have?

RM: I started working with setting up BTCXIndia in the Autumn of 2013 with the aim to create a fair, transparent and compliant platform for Indian customers. After a period of mapping out the Indian regulatory environment, raising seed capital, and developing our exchange software, we were finally able to launch BTCXIndia in May 2014. Our funding comes from a UK based angel investor who also assists the company as an advisor. Currently we have about 10 people employed in customer service, back office, development, and compliance.

BCE: Recently some bitcoin exchanges, such as Mintpal and Bter, have been attacked by hackers and lost a significant amount of coins. Do you think such attacks will intensify as the importance of crypto currency grows? What security measures your exchange implements to prevent such attacks? Talking about BTCXIndia, does it have a clear way to differentiate it from similar business?

RM: There are two areas were we think we differentiate from competition in India – the first is security, and the second is compliance. As for security, we have opted for a offline wallet system where we only keep a small fraction of customer deposits online and the rest is stored completely offline. This results in more administration than would a fully automated and online system, but it also means that we can sleep good at night and that customers can trust us with their funds. Regarding compliance, usage of bitcoin is legal in India, but the industry is unregulated and the central bank of India has warned against using crypto currency – largely due to the historically high volatility and risk of losing funds. Based on this, we took a decision to self-regulate built on best practice from the regulated financial industry. This means that we require a full KYC from all our customers before they can start trading, and should ensure that we are ready for licensing whenever this becomes relevant in India.

BCE: What needs to be done that Bitcoin would go mainstream? Will it ever rule out cash and credit cards? What are the main disadvantages of Bitcoin? Do you think it will be possible to solve them in the future or it is the concept that is flawed?

RM: I see Bitcoin as a truly revolutionary concept on the same order of magnitude as the Internet. Until now however, we have only scratched the surface of blockchain economics and crypto currency applications, but we are sure to see a lot of far reaching changes in how we view money and do business. But to do that, we also need to start somewhere, and to do this I think the Bitcoin ecosystem needs to become much more user friendly for non-technical users. For example, we see that many of BTCXIndia’s customer’s find it challenging how to securely store their bitcoins. It’s great to see how much innovation that is taking place in this area, so I am confident that this will be solved in the coming years.

BCE: How important bitcoin is for emerging markets, such as India itself? What does it give compared to regular payment methods and currencies?

RM: I believe emerging economies, and India especially, has enormous benefits to gain from a wide-spread use of crypto currency. Being a developing country where Internet access is limited, power cuts are frequent and mobile coverage is sometimes unstable; there will be quite a long way before Bitcoin replaces cash for everyday payments. That said, there are already many areas where Bitcoin simply is the best option. Some obviously examples are lower fees on remittances from abroad, easy and affordable micro-transactions, financial access for the un-banked, etc. Our hope is that BTCXIndia will play a central role in spreading Bitcoin usage in India – allowing Indians to reap the benefits of the crypto currency revolution.

Source : http://bestcoinexchange.com/exclusive-interview-with-btcxindias-rao-mupparaju/